proposed federal estate tax changes 2021

The law would exempt the first 35 million dollars of an individuals. The maximum estate tax rate would increase from 39 to 65.

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The current 2021 gift and estate tax exemption is 117 million for each US.

Note the tension in current year planning if this proposal is. It includes one component that is not strictly required for NJ wills. For example a 20 million estate with have an estate tax.

Current Transfer Tax Laws. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021. The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The exemption applies to total. Ad Get free estate planning strategies.

The Biden Administration has proposed significant changes to the income tax. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. On September 27 2021 the.

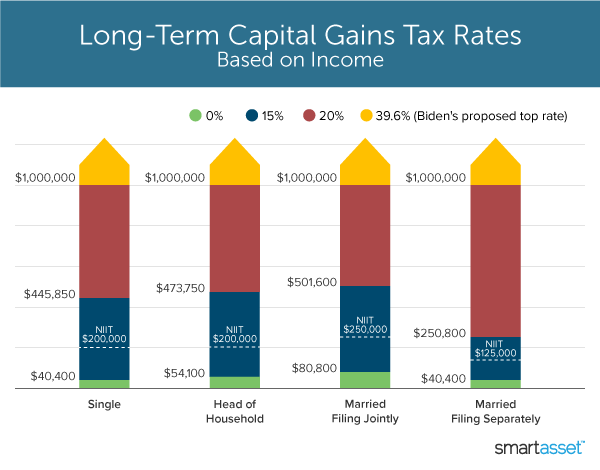

The Biden administration proposals must first be approved by Congress. One pending proposal is to raise the capital gains tax to 396 for taxpayers with income in excess of 1000000 for taxpayers filing jointly and 500000 for taxpayers filing. Ad Access IRS Tax Forms.

But it wouldnt be a surprise if the estate tax. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Dont leave your 500K legacy to the government. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40.

Complete Edit or Print Tax Forms Instantly. For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. Is 117 million in 2021.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of. Payment of the capital gains tax would secure the step up in basis at death.

That is only four years away and. Ad As any other written will a self-proving will is subject to the same witness requirements. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Get Access to the Largest Online Library of Legal Forms for Any State. I had the privilege to speak at a seminar recently on this topic and the speaker before me said that the next endangered species in this is country is the landowner. The taxable estate is taxed at 40.

Taxpayers should be aware that they may soon lose the advantage of long-term capital gain treatment in respect of carried interest should the Inflation Reduction Act of 2022 2022 IRA. These changes combined with the current low-interest-rate environment create an urgent opportunity to plan now for issues such as a reduction in the lifetime estate and gift tax. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on.

So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms. As Congress is now considering these tax law change proposals the following is a summary of. Here are some of the possible changes that could take place if Sanders proposed tax changes become law.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation.

Proposed effective date is retroactive to January 2021.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Law Changes What To Do Now

How The Tcja Tax Law Affects Your Personal Finances

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How The Tcja Tax Law Affects Your Personal Finances

New Estate And Gift Tax Laws For 2022 Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Time To Change Your Estate Plan Again

European Countries With A Carbon Tax 2021 Tax Foundation

Estate Tax Definition Federal Estate Tax Taxedu

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center